As concerns are raised about dwindling returns and an adverse impact on employment, India’s wind energy sector says it is a temporary phenomenon

The dream run of the wind sector in India has slowed for now. (Photo by Bishnu Sarangi)

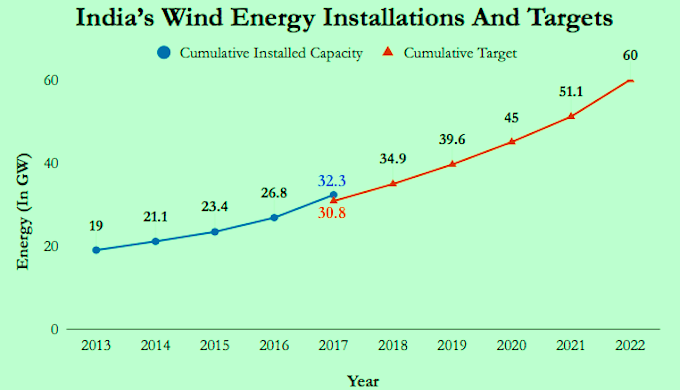

In the past couple of years, the wind energy industry in India has impressed with its stellar performance. The country had an installed wind power capacity of 32.28GW at the end of March 2017. It exceeded a target of 4GW by installing 5.4GW in 2016-17 and 3.423GW in 2015-16. By March 2017, India achieved 53% of its wind energy targets for 2022, with 32.3GW capacity installed.

This growth was owing to supportive policies including updated guidelines for the development of wind power projects and the introduction of competitive tariff bidding in wind energy auctions, according to an analysis by the World Resources Institute (WRI). In fact, India had the fourth largest wind capacity in the world after China, the US and Germany.

However, the dream run has stalled a bit, say industry experts. They cite issues where the state electricity distribution companies (discoms) have stopped signing power purchase agreements (PPAs) for projects agreed upon earlier when tariffs were higher (INR 4 to INR 6) per kilowatt hour and now have come down to INR 3.46 (USD 0.05). Apart from the fact that the business has not been as good as it was earlier, some concern was also raised following the decision of some wind energy companies to lay off a percentage of their employees. However, experts say this is only a temporary phase.

Last year, the government came up with a proposal to set up 1GW of wind power for state transmission that would have helped the states to meet their Renewable Purchase Obligations and enable transmission of energy from one state to another, according to an official at the Ministry of New and Renewable Energy (MNRE). It was decided that the tariff would be INR 3.46.

“Most of the wind energy in the FIT (Feed in Tariff) range is more than that in all the states. As a result, the states have decided not to go in for FIT regime and they are gearing up for competitive bidding in the wind energy sector also,” he told indiaclimatedialogue.net. “Since this process has begun, it will take time, about one and a half years, to stabilise it entirely. Meanwhile, the Indian government has plans to go for another bid, of 1,000 MW for all the states this financial year.”

Source: World Resources Institute

Those from states such as Tamil Nadu and Karnataka, where the winds are strong, have bid for INR 3.46. Now, if this kind of bidding is done in the states of Madhya Pradesh, Rajasthan or Maharashtra, where wind speeds are not good, this tariff will not be available. This has become counter-productive and tentatively stopped the process of bidding in the states. Some states have decided to come up with a bid again for wind. So, it is going to take time and this has resulted in slowing down of wind deployment for a while, the official explained.

In transition

“India’s wind sector is transitioning from a FIT regime to tariff-based competitive auctions,” another expert said. “While feed-in tariffs ensure a fixed price for wind power producers, wind power tariffs in India hit a record low of INR 3.46 per kilowatt hour (kWh) in a February auction conducted by Solar Energy Corporation of India (SECI).”

When it comes to wind projects, the pipeline and projects have been increasing by the day. The regulatory frameworks supporting existing wind projects are also stable, thus ensuring limited risks from regulatory side. Moreover, the government is focusing not only on building capacity through policy initiatives, but also on building evacuation capacities and making them cost-efficient.

The bid-based mechanism, the expert added, have had a successful round where 1GW was bid out by SECI earlier this year. “Hence, the overall uptrend augurs well for employment opportunities, though the incremental jobs might fall short of expectations, but I see no reason for a downward trend in employment potential for wind sector,” the source added.

“We have moved to the bidding — 3 to 4 months for the process and 18 months for the installation — so practically, a period of 21 months. Earlier, it was on feed-in-tariff, a continuous process. Now, because of this transition from FIT to bid, there may not be any capacity addition this year and maybe the next year also, so that is the only reason. We are coming out with many other bids,” the ministry official said. “As a result, I believe it is just a temporary phase.”

Sunil Jain, CEO and executive director of Hero Future Energies, believes that this is only a temporary phase and even though there will be a turbulent period of around 12 months, from mid 2018-19, the results will be positive. “Since we are moving from FIT to bidding, this change is bound to cause issues, but there is nothing to be overly concerned as it is only transitory,” he told indiaclimatedialogue.net.

Concurring, D Giri, secretary general of Indian Wind Turbine Manufacturers Association (IWTMA) is of the opinion that the current trend of layoffs in the wind energy sector is temporary and will soon pave way for far better times for the industry. “Since the sector is transiting from feed-in tariff to bidding, this is an outcome and a temporary one,” he said. While he admits that owing to the transition the next two years will be challenging, the period after that would witness the wind energy sector achieving great heights.

“This financial year will be a challenge, not the next one, since things have begun moving in the right direction and a lot of issues will be resolved,” the MNRE official said. “We will lose deployment for the next six months, but at the end of the day, it will move. So, it is not a cause to be overly concerned.”