Although India added 8.1 GW capacity of coal-fired power plants, the rate of growth is slowing significantly, even as renewable energy becomes cheaper in the country

Capacity addition of thermal power plants is slowing down in India (Photo by Sajin Panchil)

The space for coal-fired electricity continues to shrink in India, with as much as 47.4 GW of power projects at different stages being cancelled in 2019, according to a new report. These cancellations have reduced the total coal capacity under development to 66 GW.

Boom and Bust 2020: Tracking The Global Coal Plant Pipeline, the fifth annual survey of the global coal plant pipeline released this week, found that globally there was a 16% annual drop in capacity under construction and in pre-construction development in 2019. This represents a 66% decline since 2015, the report said. Construction starts were down 5% from 2018 and 66% from 2015, it said.

The report highlighted that just about 8.1 GW coal-based thermal capacity was commissioned in India in 2019, and a further 8.8 GW of new capacity entered the under-construction phase. “The shrinking coal pipeline in India forced by huge overcapacity, subdued demand for electricity, falling utilisation factor, falling prices of renewable energy, drying investments and increasing public resistance due to pollution gives hope for a future with reduced fossil footprint for India,” said Sunil Dahiya, Analyst at Centre for Research on Energy and Clean Air.

Power load factor

Although power development declined in India, the amount of new coal power capacity added to the grid in 2019 outpaced the retirement of end-of-life power plants, negatively impacting the load factor of coal plants and indicating worsening overcapacity, the report said. The entire capacity under construction received financing from the Power Finance Corporation and the Rural Electrification Corporation, both government-owned entities managed by the power ministry. The two corporations are set to be merged this year.

“New capacity is being added to the grid, new projects are given clearances and infusion of public money into new projects by the government raises concerns,” Dahiya said.

Despite the decline in development, the global coal fleet grew by 34.1 GW in 2019, the first increase in net capacity additions since 2015. Nearly 64% (43.8 GW) of the 68.3 GW of newly commissioned capacity was in China and 12% (8.1 GW) in India, the survey showed.

“Global power generation from coal fell by a record amount in 2019, as renewable energy grew and power demand slowed down,” said Christine Shearer, lead author and director of Global Energy Monitor’s Coal Programme. “Regardless, the number of new plants added to the grid accelerated, meaning that the world’s coal plants were operated a lot less. For banks and investors that continue to underwrite new coal plants, this means weakened profitability and increased risk.”

No longer a hotspot

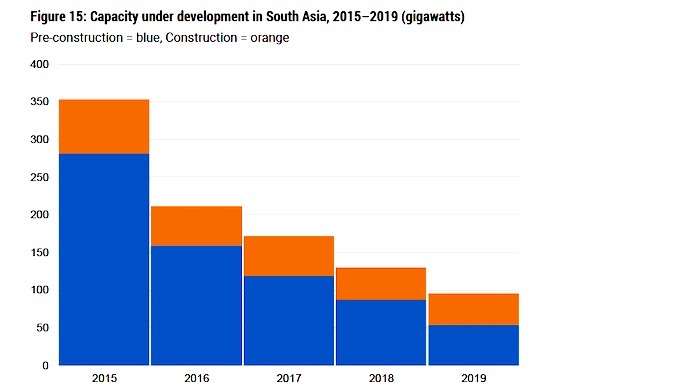

South Asia has long been identified as a hotspot of coal power growth after East Asia. However, a steady rise in coal power growth from 2011 to 2016 turned into a sudden and steep drop in 2017, due mainly to India, the survey found. Commissioning fell from an annual average of 18.9 GW from 2011-16 to 10.2 GW in 2017-19, a 46% decline.

Coal plants throughout South Asia have faced unfavourable economics, with the Indian government listing over 40 GW of the country’s coal plants as financially stressed. India’s power ministry, in a recent submission to Parliament, removed more than 23 GW capacity of coal-fired power stations belonging to the private sector from under-construction category compared to earlier data.

Source: Boom and Bust 2020: Tracking the Global Coal Plant Pipeline

Most of the reduction in the South Asia pipeline occurred in India, where capacity under construction and in pre-construction development declined 80% from 311.1 GW in 2015 to 66 GW in 2019, with only 2.8 GW newly proposed in 2019.

Solar is now 14% cheaper than coal-fired power in India, making it difficult for new coal plants to secure power purchase agreements in competitive tenders, according to Wood Mackenzie, a consultancy. Coal power generation fell 3% in 2019, due to a drop in power demand and an increase in renewable power generation, including hydropower from a strong monsoon season.

Since 2017, India has commissioned more solar and wind capacity than coal. In June 2019, the renewable energy ministry had said that it was aiming for 523 GW of renewables by 2030, which is over double the country’s currently operating coal power capacity of 229 GW.

In a move that will bring cheer to the country’s efforts to restrain greenhouse gas emissions, two major states have already announced that they will not build any new coal-fired power plants. Now a new analysis suggests that three more states may soon follow in their footsteps.

Tamil Nadu, Karnataka and Rajasthan are in a position to declare a “no new coal” policy after Gujarat and Chhattisgarh made major announcements recently in this regard, according to Winds of Change: No New Coal States of India, a report by New Delhi-based non-profit Climate Trends.

See: Major Indian states could declare no new coal

The analysis had showed that 12 other Indian states could possibly announce a no-new-coal policy, as they have high renewable energy potential. Several of them lie in India’s northeast and have low coal power capacity on the ground.

Trackbacks/Pingbacks