Although the growth in adding utility scale solar power capacity in India has been declining in recent months, the pipeline of projects remains robust, as does the employment potential

Despite a recent blimp, India’s solar sector shows promise of growth (Photo by Sebastian Ganso)

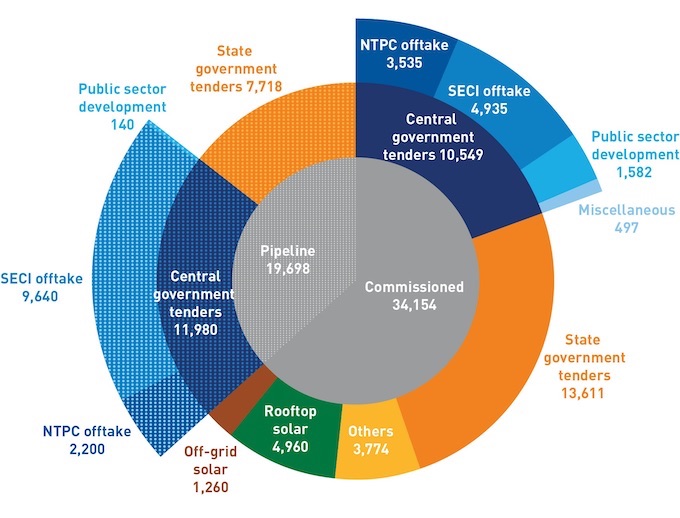

Capacity addition in India’s utility scale solar power projects has been slowing down for the last year, according to the latest quarterly report on the sector by Bridge to India. The total installed solar capacity in India grew to 34.2 GW by the end of June 2019, and capacity in the pipeline has reached 19.7 GW, the cleantech consultancy said.

The second quarter of 2019-20 “remained slow, with only 1,104 MW of capacity addition against our estimate of 1,536 MW,” Bridge to India said in its India Solar Compass Q2 2019 report published this week. But tender issuance stayed robust, with a total utility scale capacity of 10,296 MW issued in the three months ended June 30, it said. “However, many recent tenders have been cancelled and/or undersubscribed.”

India has set a target of installing 175 GW of renewable energy by 2022. The success of the renewable energy market is crucial to India’s achieving its Paris Climate Agreement targets. The South Asian nation has committed to reducing greenhouse gas emissions intensity of its gross domestic product (GDP) by 33-35% below 2005 levels by 2030, and to reaching 40% of installed electric power capacity from non-fossil sources by the same year.

Total installed and pipeline solar capacity as on June 30, 2019 in MW (Source: Bridge to India)

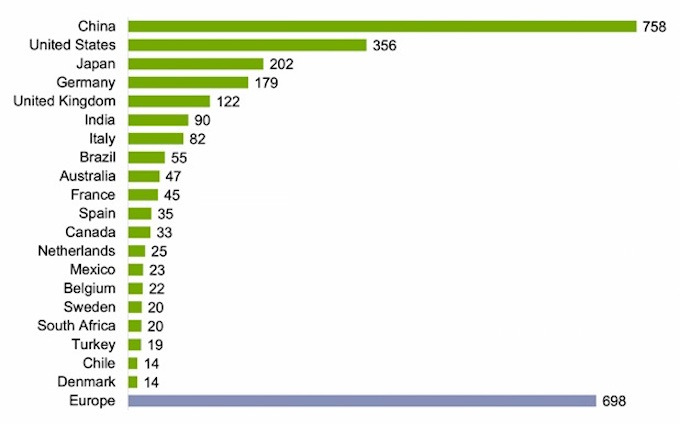

Global investment in fresh renewable energy capacity from 2010 to 2019 is on course to hit USD 2.6 trillion by the end of this year, with more gigawatts of solar power capacity installed than any other electricity generation technology, said the Global Trends in Renewable Energy Investment 2019 report, which was also released this week. The report was commissioned by the UN Environment Programme in cooperation with Frankfurt School-UNEP Collaborating Centre for Climate & Sustainable Energy Finance and produced in collaboration with Bloomberg New Energy Finance.

This investment is set to have quadrupled renewable energy capacity, excluding large hydropower, from 414 GW at the end of 2009 to just over 1,650 GW when the decade closes at the end of this year, the report said.

Solar installations in India between April and June saw a decline with 1.5 GW, a 14% decrease compared to the previous three months. Installations were down by 9% compared to 1.7 GW installed in the June quarter 2018, according to the Q2 2019 India Solar Market Update by Mercom India Research, which tracks the renewable energy sector.

Capacity addition in solar power slumped by as much as 47% in the financial year ended March 2019 to 4.81 GW, compared to the previous fiscal year (April-March), according to the India Solar Map 2019 brought out by Bridge to India. The solar sector is struggling with execution and financing challenges, including land and transmission bottlenecks, safeguard duty and increase in financing costs, the consultancy said. This slump is expected to be temporary, experts said.

Investment in renewable energy capacity from 2010 to June 2019 for top 20 countries in USD billion (Source: Global Trends in Renewable Energy Investment 2019)

Investment in India fell 16% to USD 15.4 billion in 2018, although this was the country’s second-highest annual total to date, international think tank REN21’s Renewables 2019 Global Status Report had said in June. The investment decline reflected uncertainty in import tariffs and exchange rates. Investment in wind power equalled its 2016 record, at USD 7.2 billion, but investment in solar power declined 27% to USD 8.2 billion.

See: Policy uncertainty hamstrings renewables growth

The slowdown has hit jobs growth in the renewable energy sector. Only 12,400 new workers were employed between April 2018 and March 2019 by utility-scale solar, rooftop solar and wind energy projects, compared to 30,000 new workers in the previous financial year, according to Powering Jobs Growth with Green Energy, a report released in July by the Council on Energy, Environment and Water (CEEW), the Natural Resources Defence Council (NRDC) and the Skill Council for Green Jobs (SCGJ).

The Goods and Services Tax (GST), imposition of the safeguard duty to help domestic manufacturers at the cost of project developers, payment delays by power distribution companies, lack of finance and infrastructure constraints were key reasons behind the renewables slowdown, the jobs report said. “Policy certainty, government support and lowering the cost of finance will be key to sustaining the growth of India’s renewable energy markets, and in turn the renewable energy workforce,” it said.

See: Slowdown impacts jobs growth in renewables sector

However, things have looked up since then. After a spate of policy related announcements in the first quarter of 2019-20, the next three months were “much quieter” on the policy front, Bridge to India said.

India’s renewable energy workforce has expanded five times in the past five years. In 2019, about 100,000 workers are employed in the solar and wind industries, up from 19,800 workers in 2014, according to the jobs report.